Introduction

When stocks plummet, residential real estate stands strong—discover how to diversify for lasting wealth. Imagine watching your retirement savings drop 19% in a single year. That’s exactly what happened to S&P 500 investors in 2022 when inflation, rising rates, and recession fears triggered a sharp market correction.

While this discussion is intended to help you scale, it reflects the professional opinion of Elysium Real Estate Investments. Our investment opportunities are restricted to accredited investors under Regulation D. In 2026, the active exemptions are limited to Rule 506(b), Rule 506(c), and Rule 504. Please consult with your own legal and financial team before making decisions based on this article.

The Problem with Paper Assets

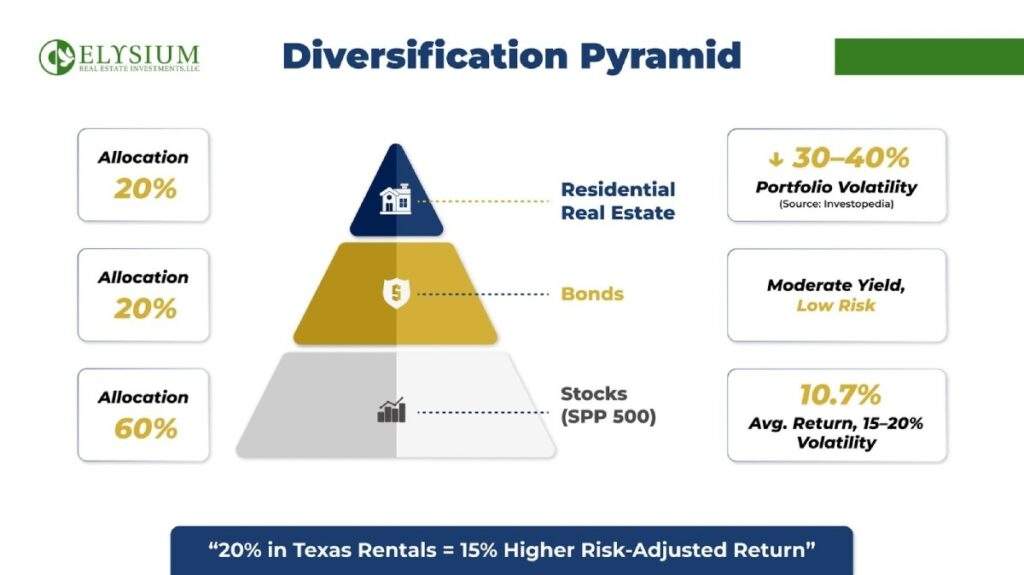

Real estate portfolio diversification isn’t about abandoning stocks. It’s about balance. Today, investors are increasingly concerned about currency debasement and the erosion of purchasing power in traditional equity markets. By reallocating just 20–30% of your assets into property investment, you can significantly reduce volatility, improve risk-adjusted returns, and create multiple streams of income.

Whether you’re a Portfolio Builder actively managing diverse assets to optimize ROI amid unpredictable market swings, or a Buy-and-Hold Strategist seeking low-maintenance, inflation-resistant wealth for retirement or legacy, real estate investing in Texas offers a proven path forward.

Risks of S&P 500 Over-Dependence

While the S&P 500 has averaged strong annual returns over the past century, sharp drawdowns are expected. Sophisticated investors recognize that newly created money does not enter the economy uniformly, meaning those closest to the source of money creation benefit at the expense of others.

For the Portfolio Builder, these swings disrupt compounding and force reactive decisions that can jeopardize long-term goals. For the Buy-and-Hold Strategist, they threaten decades of careful planning, proving that over-reliance on a single asset class is a vulnerability in any high-net-worth strategy.

Stock Market Swings vs. Real Estate Consistency

Stocks move in lockstep with sentiment; residential real estate moves with people. While a single tweet or earnings report can send a stock price tumbling, the value of a home is anchored by the fundamental human need for shelter. Unlike fiat currency, residential real estate is a finite resource with intrinsic utility that historically keeps pace with M2 money supply growth. This physical utility provides a floor for the asset’s value that paper assets simply do not possess.

Correlation Risks in Equities

When tech crashes, diversified stock portfolios often suffer together because the underlying market sentiment is shared across sectors. While the S&P 500 offers growth, it lacks the inflation-adjusted stability and tax advantages inherent in direct property ownership. Residential real estate, however, operates on local fundamentals: job growth, migration, school quality, and infrastructure, providing a true hedge that is uncorrelated with the New York Stock Exchange.

True portfolio diversification reduces “unsystematic risk”—the kind tied to individual assets or sectors. Real estate investing tips consistently emphasize this: adding uncorrelated assets like rental homes smooths returns without sacrificing growth.

Benefits of Residential Real Estate

Property investment isn’t just an asset class—it’s a wealth engine with four cylinders: Cash Flow, Appreciation, Tax Advantages, and Leverage.

Tangible Asset Stability

You can’t touch a stock certificate, but you can walk through a three-bedroom home in Frisco, Texas. Texas home prices remained stable in Q2 2025, with the statewide median at $340,000—a modest 1.4% shift YoY. TheTRERC Home Price Index showed 0% YoY change in June, confirming balance.

Texas led the nation in home sales volume in July 2025, closing 31,398 transactions (new + existing)—capturing 8.1% of all U.S. sales that month. Year-to-date, Texas holds an 8.6% national share. Sales momentum accelerated with a 3.3% YoY gain in July, pushing YTD volume above 2024 levels for the first time this year. Pending sales jumped 10.4% YoY, confirming strong buyer demand heading into fall.

With 726 people moving to Texas daily from out-of-state—totaling 265,112 annual inflows (June 2024–May 2025, according to HireAHelper 2025 Report)—demand for quality suburban housing remains strong. This steady population engine, led by workforce families from California and Florida, supports long-term price resilience and rental demand.

Statewide, inventory sits at a healthy 5.7 months’ supply with median prices holding at $340,000 (TRERC July 2025). In the Austin metro, the median sales price was $439,000, up 1.4% year-over-year, as per KXAN, as of Oct 2025 —unlocking prime opportunities for cash flow and appreciation in a market still absorbing new residents.

Passive Income Through Rentals

In a prime suburb like Round Rock, a 4-bedroom home purchased for $450,000 with 20% down rents for $2,800/month. After mortgage, taxes, insurance, and maintenance, net cash flow exceeds $1,200 monthly—a 6.4% cash-on-cash return (estimated using standard 50% expense rule and 6.75% mortgage rate, per Freddie Mac PMMS).

For the Buy-and-Hold Strategist, this is retirement redefined: income without selling assets and a low-maintenance path to long-term financial security.

The Power of Financial Leverage

With a 20% down payment, you control 100% of a property’s cash flow and appreciation. This means that if the home increases just 5% in value ($22,500), your actual equity grows by 25% on your initial $90,000 investment. This ability to use institutional capital to amplify personal gains is one of the most powerful wealth-building tools available to real estate investors.

Excited to stabilize your portfolio in 2025? Let Elysium Real Estate Investments assess your diversification needs—for free.

Connect With An Elysium Advisor

Want to dive deeper? Grab a 30-minute Zoom consultation: Schedule Here

Need to speak to one of us quickly? Book a 20-minute call: Schedule Here

Texas as a Growth Engine:The Economic Moat

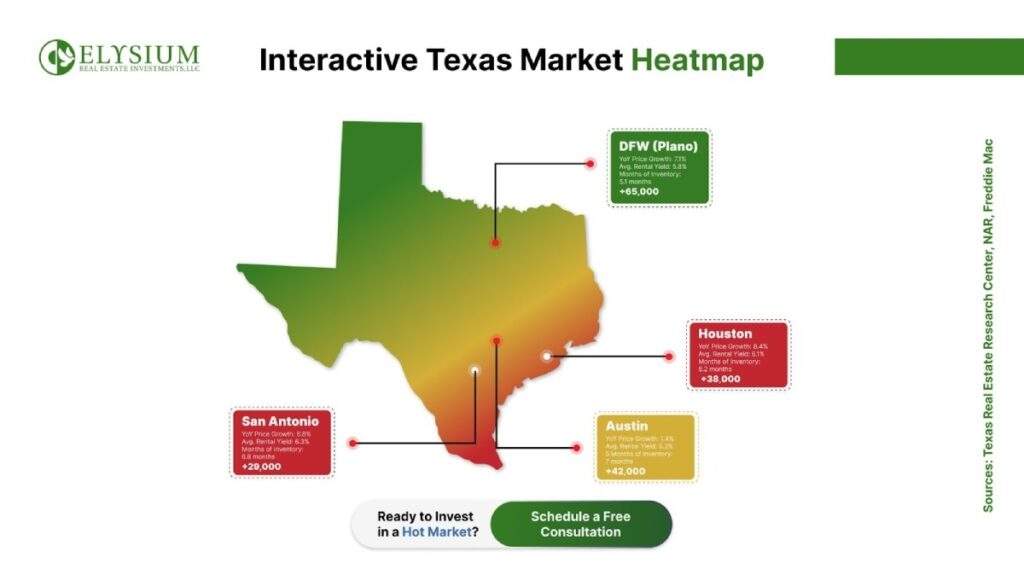

Texas stands apart from the national landscape, driven by the explosive growth of metros like Austin, Houston, and Dallas-Fort Worth (DFW). Austin, for instance, has solidified its status as a premier tech hub with nearly 35% population growth since 2010. This sustained expansion is not accidental; it is the result of a deliberate pro-business environment that continues to attract both institutional capital and individual residents.

The Intersection of Policy and Demand

The “Texas Miracle” is anchored by a unique economic moat: the absence of state income tax combined with aggressive corporate relocations from high-tax states. These factors create a permanent, high-velocity demand for housing that consistently outpaces supply. This insulation from global volatility creates a specific opportunity for the Portfolio Builder seeking alpha beyond traditional benchmarks, as areas like Plano maintain stable pricing with median sale prices around $500,000 as per Redfin October 2025 data.

Though construction is largely driven by local demand, investors should be aware of macro forces like global trade policy that impact building costs—read our analysis on how tariffs are influencing real estate economics.

Market-Driven Investment Opportunities

The current economic landscape in 2026 demands a shift from speculative buying to data-backed asset acquisition. For the Portfolio Builder, identifying market-driven opportunities means looking beyond simple appreciation and focusing on sustainable demand drivers. Texas continues to offer unique pockets of value where infrastructure projects and corporate headquarters act as permanent anchors for residential value.

Capitalizing on High-Growth Submarkets

Strategic investment in 2026 is less about the “major city” and more about the “strategic suburb.” Submarkets within the DFW metroplex and the outskirts of San Antonio are currently presenting the strongest risk-adjusted returns. For the Buy-and-Hold Strategist, targeting newer single-family homes in these areas is the preferred route, as these assets offer the lowest maintenance overhead while capturing the steady rental growth characteristic of these burgeoning economic corridors.

Leveraging Market Volatility

While traditional S&P 500 investors often panic during periods of high interest rates, the sophisticated real estate investor views these as entry windows. High-interest environments naturally thin out the competition from emotional homebuyers, allowing the Portfolio Builder to negotiate better terms and acquire higher-quality assets that will appreciate significantly when the cycle pivots.

To gain further insights and in-depth information, we invite you to explore other related blogs, including our in-depth guide on advanced strategies to scale your Texas real estate portfolio. This resource provides valuable guidance for navigating investment portfolio strategy in North Texas.

Standardized Asset Criteria & Diversification

Success is about having the right strategy and scaling intelligently through disciplined property selection. We advise looking for 3–4 bedroom homes under $500,000 situated in top-tier school districts to ensure long-term demand and high-quality tenants.

Optimizing for Low Maintenance

Newer homes are critical for the Buy-and-Hold Strategist as they translate to lower maintenance and turnkey simplicity. The Portfolio Builder uses this criteria, informed by Elysium’s proprietary market data, to minimize unsystematic risk and optimize rental yields through vetted vendor networks like the Elysium Property Management Network to ensure the investment remains truly passive.

Precision Portfolio Tracking: The Investor’s Dashboard

Scaling a real estate portfolio beyond the S&P 500 requires a shift from passive observation to active, data-driven management. For the Portfolio Builder, high-level tracking is the only way to identify underperforming assets and pivot capital into higher-yield opportunities. In the 2026 market, where precision is paramount, tracking your Key Performance Indicators (KPIs) quarterly ensures that your residential assets are truly serving as a stabilizer for your broader wealth strategy.

Critical KPIs for the Modern Investor

We recommend that both the Portfolio Builder and the Buy-and-Hold Strategist monitor a specific set of metrics to ensure portfolio health. While the S&P 500 offers a single “ticker price,” real estate provides multiple levers of value that must be measured independently:

- Cash-on-Cash Return: Aim for a target of >8%. This measures the annual pre-tax cash flow relative to the total amount of cash invested, providing a clear picture of your immediate liquidity.

- Cap Rate (Capitalization Rate): A healthy range for Texas residential assets in 2026 is 5–7%. This metric allows you to compare the profitability and risk levels of different properties regardless of their financing structure.

- Vacancy Rate: Maintain a target of <5%. In high-demand markets like Plano or Round Rock, a rate higher than this often signals a need to review property management efficiency or rental pricing.

- Equity Growth: For those scaling for legacy, a target of $50,000+ per year in total equity growth (combining principal paydown and appreciation) ensures the portfolio is compounding at a rate that outpaces inflation.

Multi-Unit Portfolio Expansion

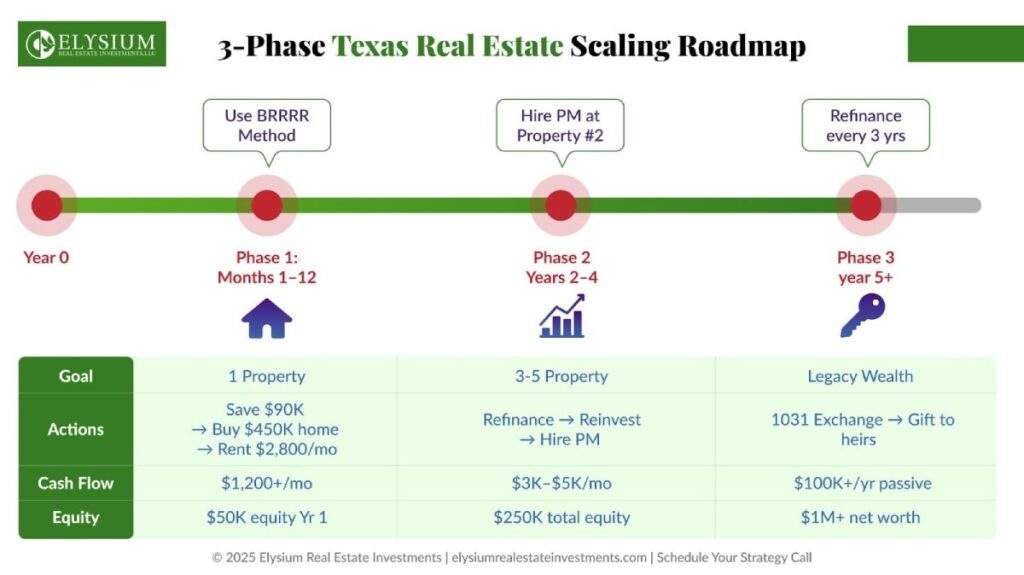

Scale using the “BRRRR” model. A key part of scaling is partnering with a team that provides turnkey solutions to ensure the Buy-and-Hold Strategist maintains a low-maintenance portfolio even as it grows.

Wondering how multi-family fits into how to scale your real estate portfolio without overextending? Dive into our tactical breakdown on smart leverage strategies for maximizing real estate returns without excessive risk. We cover financing stacking, tenant overlap strategies, and exit timelines.

A key part of scaling is partnering with a team that provides turnkey solutions—read our guide on the benefits of professional property management in Texas to understand how. This ensures the Buy-and-Hold Strategist maintains a low-maintenance portfolio even as it grows.

Phased Scaling Framework

Phase 1: Entry-Level Property Acquisition (Months 1–12):

The goal is one cash-flowing asset to establish a baseline. Perfect starter for the Portfolio Builder testing systems. The Buy-and-Hold Strategist should prioritize newer, turnkey homes to minimize early costs.

Phase 2: Scaling with Market Research (Years 2–4)

Expand to 3–5 properties. Use NAR and local MLS data monthly and leverage Elysium’s proprietary market reports for hyper-local intelligence. Hire a property manager to guarantee low-maintenance cash flow.

Phase 3: Legacy Wealth Optimization (Year 5+)

Focus on generating $100,000+ in annual passive income. This is the Buy-and-Hold Strategist’s endgame: wealth that lasts generations with minimal ongoing effort, supported by professional management. The Portfolio Builder uses this phase for advanced tax planning.

Want to master cap rate calculations, ROI forecasting, and tax optimization for your Texas real estate holdings? Our comprehensive guide breaks down the new tax advantages under the One Big Beautiful Bill. It shows how bonus depreciation, expanded improvement deductions, and favorable capital gains treatment can supercharge your portfolio’s after-tax returns in high-growth markets like Austin, Houston, and DFW.

Conclusion

Strategic residential investment serves as a multigenerational wealth preservation tool in an era of unprecedented monetary expansion. By moving beyond paper assets, the Portfolio Builder gains precision scaling with data and systems (including Elysium’s market data). The Buy-and-Hold Strategist secures generational wealth with minimal ongoing effort through low-maintenance, turnkey investments and professional management.

Let’s turn market volatility into your greatest opportunity. Partner with Elysium to build a truly low-maintenance, high-yield portfolio. To learn more, read our guide on the benefits of professional property management in Texas.