Construction loans are essential for many real estate investors and developers. They provide the necessary funds to build new properties or renovate existing ones. Without these loans, many projects would never get off the ground.

However, managing a construction loan comes with its own set of challenges. Cost overruns and project delays are common issues that can derail even the best-laid plans. Proper management of the loan can help mitigate these risks. By keeping a close eye on the budget and timeline, you can ensure your project stays on track.

Taking the time to understand the ins and outs of construction loans can save you a lot of trouble down the line. Knowing the key terms and requirements, staying on top of your budget, and maintaining open communication with your team are all vital parts of successful loan management. With the right approach, you can navigate these challenges and bring your project to completion on time and within budget.

Understanding Construction Loans

What Is a Construction Loan?

A construction loan is short-term financing used to cover the cost of building or renovating a property. These loans are different from traditional mortgages. While a traditional mortgage is used to purchase existing property, a construction loan funds the building process. It’s typically disbursed in stages, known as draws, which correspond to specific phases of the construction project. As the work progresses, funds are released to pay for labor and materials.

Types of Construction Loans

1.Construction-to-Permanent Loans: These loans start as construction financing but convert to a permanent mortgage after the building is completed. This option can save time and money by eliminating the need for a second loan process.

2.Stand-Alone Construction Loans: Also called “construction-only loans,” these require you to obtain a separate mortgage once your project is finished. This can be advantageous if you expect interest rates to fall or your financial situation to improve by project’s end.

3.Owner-Builder Loans: These loans are for investors who act as their own general contractors. This option is riskier and often requires proof of construction experience and a strong credit profile.

Key Loan Terms and Requirements

– Loan-to-Cost (LTC) vs. Loan-to-Value (LTV) Ratios: LTC is the ratio of the loan amount to the total project cost. LTV compares the loan amount to the property’s value once completed.

– Draw Schedules and Inspections: Funds are released in stages based on the project’s progress. Inspections ensure the work aligns with the approved plan.

– Interest Rates and Repayment Terms: Construction loans typically have higher interest rates than traditional mortgages. Borrowers often make interest-only payments during construction, with the principal due upon completion or conversion to a permanent loan.

Staying on Budget

Set a Realistic Budget Upfront

Creating a realistic budget at the start of your project is key. Account for every cost, including materials, labor, permits, and soft costs like design and legal fees. Don’t forget to include a contingency fund, typically 10-20% of your budget, to cover unexpected expenses. A well-planned budget helps you avoid financial surprises and keeps your project on track.

Work with an Experienced General Contractor

Your contractor plays a vital role in staying within budget. A seasoned contractor can provide accurate estimates and help avoid common pitfalls. Make sure to vet potential contractors by checking references and past projects. It’s wise to secure fixed-price contracts where possible. This ensures you know exactly how much you’ll be spending and protects you from price increases.

Monitor Loan Draws Closely

Understanding your loan’s disbursement schedule is crucial. Funds are released in stages, so track spending meticulously. Ensure each draw is properly allocated to the right parts of the project. Regularly review expenses against your budget to catch overruns early. By keeping a close eye on finances, you can make timely adjustments and maintain control over your budget.

Plan for Unexpected Expenses

Even the best-planned projects encounter surprises. Have strategies in place to manage unexpected costs without compromising quality. This might mean re-evaluating non-essential features or negotiating better prices for materials. A flexible approach allows you to adapt and keep your project moving forward smoothly. Being prepared helps ensure that unexpected expenses don’t derail your budget.

Keeping Your Project on Schedule

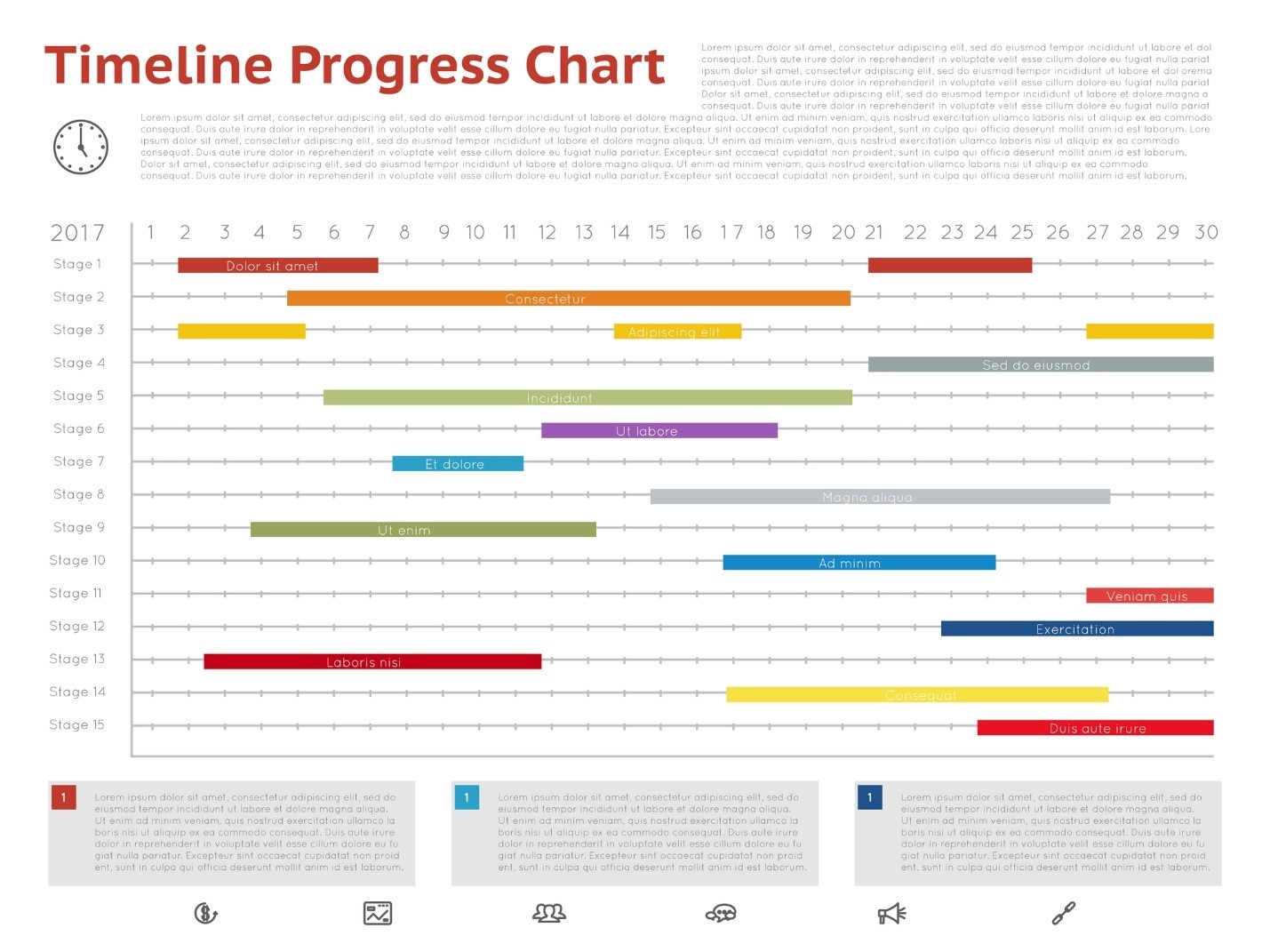

Create a Detailed Project Timeline

Creating a detailed project timeline is crucial to keeping your construction project on track. Work closely with your contractors to set realistic milestones for each phase of the project. Break the project into smaller tasks and assign deadlines to each. Using project management software can help you track progress and ensure tasks are completed on time. A clear timeline keeps everyone on the same page and allows for efficient coordination.

Avoid Common Delays

Preventing delays can save both time and money. Some common causes of delays include:

– Permit and Approval Bottlenecks: Ensure you have all necessary permits and approvals before starting. These can take time, so plan ahead.

– Supply Chain Disruptions: Order materials in advance to avoid delays caused by backorders or shipping issues.

– Weather-Related Setbacks: Plan buffer time into your schedule to account for possible delays due to weather conditions.

By anticipating these issues, you can put measures in place to avoid or minimize their impact.

Maintain Regular Communication

Regular communication with your contractors and team members is vital. Hold weekly check-ins to discuss progress, address any issues, and make adjustments to the plan as needed. These meetings ensure everyone is up-to-date and can help prevent miscommunications that could lead to delays. Promptly addressing any problems that arise helps keep the project on schedule.

Managing Loan Repayments and Exit Strategies

Understanding Interest Payments

Understanding how interest payments work on construction loans is essential. During the construction phase, most lenders require interest-only payments. This means you’ll pay interest on the amount drawn from the loan, not on the total loan amount. Once construction is complete, you will need to transition to long-term financing, where you will start paying both principal and interest.

Exit Strategies for Investors

Having a solid exit strategy is crucial for managing your construction loan effectively. Here are a couple of common strategies:

– Refinancing into a Long-Term Loan: Once the construction is complete, you can refinance the construction loan into a traditional mortgage. This approach spreads the repayment over a longer period and often comes with lower interest rates.

– Selling the Property: Another strategy is to sell the property post-construction. This can help investors recoup their investment quickly and potentially make a profit. Ensure the property is market-ready to attract buyers.

By planning your exit strategy early, you can align your financial goals with your construction project’s completion.

Conclusion

Managing a construction loan involves understanding complex financial terms, creating a detailed project plan, and staying on top of your budget and timeline. By doing so, you can avoid common pitfalls like cost overruns and project delays. Whether you’re a high-net-worth individual, a retirement planner, or a real estate professional, these real estate strategies can help ensure your construction project is completed on time and within budget.

At Elysium Real Estate Investments LLC, we strive not just for real estate success but for a meaningful impact on the communities we serve. Through our partnerships with non-profits across Texas, we are dedicated to making a positive difference. If you found this guide helpful, please visit our Giving Back page. Every donation you make to one of our vetted Social Impact Partners, no matter how small, goes directly to them and helps us create lasting change and empowers us to continue providing you valuable insights for navigating today’s real estate market.

Are you ready to take the next step in your real estate journey? Contact us today for a Free consultation. Let’s build a brighter future together.

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or professional advice. Construction loans involve complex financial and contractual considerations, and readers should consult with qualified financial advisors, loan officers, and legal professionals before making any decisions. Elysium Real Estate Investments makes no guarantees regarding the accuracy, completeness, or applicability of the information provided. Loan terms, lender requirements, and market conditions may vary, and readers are encouraged to conduct their own due diligence. Elysium Real Estate Investments is not responsible for any financial or legal outcomes resulting from the use of this information.