Global trade tensions don’t pause for construction schedules. When tariffs hit, the Portfolio Builder faces a hidden threat to their 10-year ROI from rising material expenses. Meanwhile, the Fix-and-Flip Entrepreneur sees renovation budgets strained by sudden price increases, cutting into tight margins.

At Elysium Real Estate Investments, we believe in investing beyond the headlines. Risk mitigation strategies rooted in Texas’s resilient markets and disciplined planning can transform tariff volatility into opportunity. This article provides a data-driven framework to shield your projects, whether you’re scaling a portfolio or flipping a single-family home.

Understanding Tariff-Driven Risk

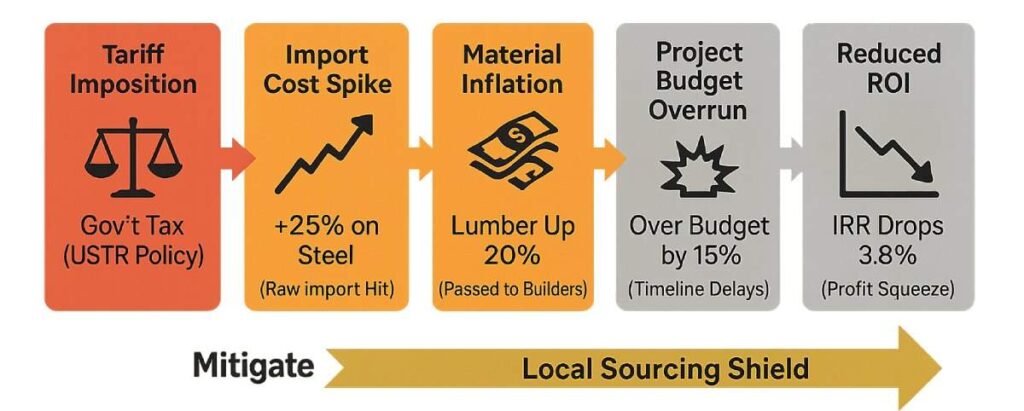

Tariffs, simply put, are government-imposed duties on imports that can sharply increase prices of construction materials, finished goods, and fixtures. In real estate, they act as silent cost inflators, disrupting budgets and timelines.

The U.S.Trade Representative (USTR) enforces 50% tariffs on steel, 10% on aluminum (whitehouse.gov), and 10% on Canadian lumber (NAHB) under recent Section 232 actions (USTR, 2025). This tariff impact on real estate ripple through material costs, supply chains, and investor returns.

The Mechanics of Tariffs in Construction

For the Portfolio Builder, tariffs on steel can inflate structural costs significantly on a mid-rise project. A large apartment complex could face substantial unexpected expenses as prices for key components rise.

The Fix-and-Flip Entrepreneur feels the pinch differently. A typical rehab budgets for framing lumber, but when tariffs push prices higher, that adds meaningful pressure to the overall spend—potentially halving projected profits.

These aren’t isolated incidents. Tariffs reshape every line item, from rebar to roofing, forcing developers to rethink construction project risk management. Builders must evaluate how imported dependencies expose their plans to external shocks, prompting a shift toward more stable sourcing options.

The Ripple Effect: Rising Costs, Supply Chain Strain, and Delayed Timelines

Tariffs don’t just raise prices—they disrupt schedules. A delay on imported HVAC units from Asia stalls electrical and drywall trades. In Houston, where skilled electricians command premium rates during peak demand, even a short holdup with a full crew adds considerable labor overruns.

General conditions—site security, equipment rentals, insurance—compound the pain. A month-long delay on a major project burns through soft costs quickly. Without real estate investment risk mitigation strategies, these ripples erode investor confidence and

compress ROI, turning a solid pro forma into a cautionary tale. Proactive monitoring of global trade news becomes essential to anticipate and address these cascading effects.

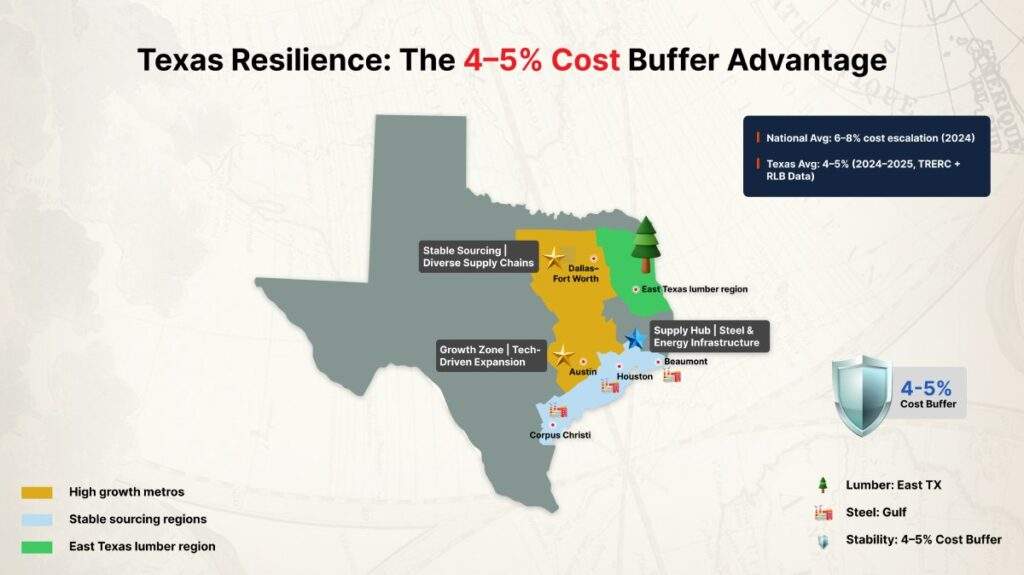

The Texas Advantage: Local Strength in a Global Market

Texas isn’t just a market—it’s a fortress. Texas limits tariff effects through domestic production. Construction costs rose 6–8% nationally, but Texas metros averaged only 4–5% thanks to robust domestic supply chains and pro-growth policies. This resilience gives investors a competitive edge in navigating tariff pressures.

Domestic Supply Resilience

Texas produces ample lumber across numerous East Texas sawmills, covering a large share of the state’s framing needs. Gulf Coast steel plants in Houston and Beaumont deliver rebar and beams with short lead times.

For the Portfolio Builder, this means project risk mitigation strategies grounded in predictable pricing and reduced import dependency. Local availability allows for quicker adjustments when global disruptions occur, keeping projects moving without the uncertainty of overseas shipping.

Pro-Growth Policy Environment

Frisco’s parallel plan review cuts multifamily permitting to under a month, saving significant carrying costs compared to coastal markets. Houston’s streamlined inspections reduce timeline risk substantially.

Success in these high-growth markets hinges on balancing risk and opportunity. Learn how to navigate these high-potential Texas investments safely in our related analysis.

Regional Contractor Ecosystem

With thousands of licensed contractors and a deep pool of construction workers, Texas’s labor force absorbs global shocks effectively. Strong local networks enable rapid pivots to domestic alternatives, ensuring real estate project management stays on track even during international disruptions.

From Austin’s innovation corridors to Houston’s industrial zones, local contractors are adapting to tariffs through bulk buying, modular construction, and regional manufacturing partnerships. This interconnected web of reliable partners fosters efficiency and adaptability in the face of trade uncertainties.

How Tariffs Impact Texas Projects

Texas’s advantages don’t eliminate tariff risk—they mitigate it. The Texas Real Estate Research Center reports steady increases in the value of single-family construction starts across major metros, reflecting rising costs from materials and labor (TRERC, 2024). For example, statewide construction values rose 35% YoY from January 2023 to January 2024, with Dallas and Houston showing strong growth in project scale and cost.

Cost Escalation Across Major Metros

In Austin, where luxury flips rely on imported fixtures, tariffs add notable pressure to finish-out costs. A Fix-and-Flip Entrepreneur targeting high-end sale budgets for appliances, but a tariff spike erodes profit margins quickly, demanding careful line-item scrutiny. Developers in growth areas must balance premium features with cost controls to maintain viability.

Supply-Chain Delays and Labor Costs

A delay in imported materials triggers overtime for local trades. Port congestion, worsened by tariff inspections, extends container dwell times, with developers facing increased demurrage and holding costs.

Real estate investment risk grows when schedules slip, exposing projects to weather, theft, and financing penalties. Early identification of vulnerable supply points allows teams to reroute resources and minimize downtime.

Investor Sentiment and ROI Compression

The Portfolio Builder modeling a strong IRR on a 10-year multifamily hold faces cap rate compression as carrying costs rise. Limited partners demand answers, and confidence wanes without a clear mitigation plan. In uncertain times, transparent communication and contingency planning become key to sustaining stakeholder trust.

Core Project Protection Strategies

Risk management in real estate is proactive, not reactive. These tariff risk mitigation strategies—field-tested across Elysium’s Texas portfolio—deliver stability for both personas.

Diversify Supplier Networks

For Portfolio Builders:

- Partner with three regional suppliers (e.g., Nucor Texas, Texas Concrete, McCoy’s Lumber)

- Maintain one national fallback (e.g., U.S. Steel)

- Run quarterly RFQs to benchmark pricing

- Use digital vendor platforms like Procore for real-time cost tracking

For Fix-and-Flip Entrepreneurs:

- Secure two local lumber yards and one big-box alternate (Home Depot Pro)

- Store vendor scorecards for price, reliability, and lead time

- Pre-negotiate alternate SKUs to pivot within 48 hours

Lock in Fixed-Rate Contracts

Execute material contracts 90–120 days pre-construction with:

- Fixed unit pricing

- Delivery windows ±7 days

- Penalties for delays ($500/day)

- Tariff exclusion clauses

Pair with fixed-rate construction loans to lock in capital costs and shield against rate volatility. This dual-lock approach insulates total project financing from volatility, providing peace of mind through predictable outflows.

For a deeper dive into structuring deals for maximum returns, explore our guide on using smart financing to boost returns while controlling exposure.

Include Cost-Escalation Clauses

Draft contracts that:

- Cap pass-throughs at 5% annually

- Require 30-day tariff notices

- Allow substitution rights for domestic materials

- Trigger renegotiation above 10% increases

This protects the Portfolio Builder over a 24-month build and the Fix-and-Flip Entrepreneur over a 6-month flip, allowing flexibility without full exposure to market swings.

Source Materials Regionally

Texas produces:

- Southern Yellow Pine (East Texas)

- Structural steel (Houston, Beaumont)

- Limestone/granite (Hill Country)

- Clay brick (Elgin, Acme Brick)

Prioritizing these sources reduces exposure to international freight risks and tariff surcharges while supporting faster delivery and lower transportation costs. Local sourcing not only cuts expenses but also aligns with sustainable practices, appealing to eco-conscious investors.

Need tailored advice? Schedule a FREE 30-minute Zoom consultation with Elysium’s risk team to audit your project and build a tariff-proof plan. Schedule Here.

Financial Hedging & Cash-Flow Control

Capital stability is as critical as material sourcing. Hedging in real estate means aligning debt, equity, and reserves to weather tariff shocks.

Fixed-Rate Financing

Lock construction loans before tariff-driven inflation pressures the broader economy.

Tariff-driven material inflation contributes to overall price growth, prompting the Federal Reserve to raise interest rates to stabilize inflation.

This link makes fixed-rate financing a direct tariff mitigation strategy—not just a financial preference. Securing a fixed rate early shields investors from upward borrowing costs that often follow global material price surges.

Elysium structures loans with interest reserves tied to milestone draws, ensuring that tariff delays don’t trigger defaults. This dual-protection approach keeps capital predictable even as the cost of materials and money rises together.

Contingency Reserves

Build 10–15% hard cost buffers and 5% soft cost reserves to maintain liquidity throughout your project.

Fix-and-Flip Entrepreneur:

- Add a buffer to a standard rehab budget.

- Keep a secondary vendor quote ready to pivot if prices rise unexpectedly.

Portfolio Builder:

- Model reserves on a full-scale build with both hard and soft cost contingencies.

- Maintain flexible access to capital for quick response to material or labor spikes.

These reserves act as a financial safety net, allowing quick responses to unforeseen escalations while protecting ROI.

ROI Reforecasting for Volatility Planning

Update pro formas monthly using:

- ±15% material cost swings

- ±30-day schedule risk

- ±1.5% interest rate volatility

Regular reforecasting enables proactive adjustments, such as accelerating trades or reallocating budgets, to maintain target returns. This ongoing process turns potential threats into manageable variables.

Investor Strategy Guide: Putting Protection into Action

This checklist ensures both personas thrive in a tariff-driven market:

For Portfolio Builders:

- Diversify across three Texas regions (DFW, Houston, Central Texas)

- Secure 24-month fixed contracts with 5% escalation caps

- Reforecast ROI quarterly with 5% volatility bands

- Maintain 12% contingency across trades

- Stress-test debt at +2% rates

For deeper insights on optimizing returns in this regulatory environment, explore our analysis of leveraging new tax policies to strengthen residential holdings.

For Fix-and-Flip Entrepreneurs:

- Lock pricing 60 days pre-start

- Add 10–15% contingency per line item

- Partner with two local suppliers per trade

- Use bid tracking tools (Buildertrend, CoConstruct)

- Pre-negotiate change orders under 3%

Conclusion

Tariffs test resilience, but Texas investors hold the upper hand. With local sourcing, fixed-rate contracts, and data-driven hedging, you don’t just survive—you outperform. Elysium has guided substantial Texas projects through tariff cycles, delivering strong average IRR in volatile markets.

Staying ahead requires a 360-degree view. For more on how broader trade policies reshape real estate economics, read our guide on navigating evolving trade policy impacts.

Excited to protect your next project from tariff risk? Let Elysium Real Estate Investments help you build with confidence. Schedule a FREE 30-minute confidential consultation with our advisors over Zoom to audit your exposure and craft a custom plan.