The Federal Reserve’s recent moves have ignited a fierce tug-of-war in real estate. In September 2025, the Fed cut its benchmark rate by 25 basis points, dropping it to a target range of 4%-4.25% . This aims to spark affordability in the recession and housing market landscape, but looming recession fears—with economic growth slowing—create uncertainty. Did housing rates go down? Yes: 30-year fixed mortgage rates fell to 6.32% by early October 2025, down from summer highs. Yet, the threat of an economic downturn keeps investors on edge.

This clash defines 2025: rate cuts and recession fears pulling in opposite directions. Lower rates could unlock buyer demand and boost cash flow, but recession risks challenge job stability and pricing. For the Buy-and-Hold Strategist, it’s about securing stable cash flow through timely refinances. For the Portfolio Builder, it’s spotting opportunities in resilient markets like Texas.

At Elysium Real Estate Investments, we provide clarity with actionable insights. This article unpacks the dynamics, focuses on Texas’s outlook, and offers strategies to turn volatility into value. Whether you’re wondering will the housing interest rates go down further or when will the Fed lower interest rates again, read on to navigate this shifting landscape.

The Rate Cut Effect

The Fed’s September 2025 cut was a lifeline for a housing market desperate for affordability. With inflation cooling, more cuts are likely. But are housing interest rates going to drop further? Forecasts suggest a gradual decline, potentially to 5.9% by end-2026 , offering investors a window to refinance or acquire properties at lower costs. This creates a dual opportunity: lower borrowing costs enhance cash flow for existing assets, while new purchases become more attractive, especially in high-growth regions.

Did Housing Rates Go Down?

Yes, and the impact is clear. Mortgage rates dropped to 6.32% in early October 2025, the lowest in nearly a year, fueling buyer interest. [mortgagenewsdaily.com]. When will home interest rates go down more? Experts predict around 6.4% by year-end if the Fed continues easing [fanniemae.com]. Learn more about why low rates may not guarantee a housing boom.

Lower rates mean more qualified buyers and lower debt service for investors, freeing capital for growth. For example, refinancing a $500,000 loan from 7% to 6.32% saves approximately $2,256 annually, a direct boost to cash flow. This is a pivotal moment for Buy-and-Hold Strategists to lock in savings and for Portfolio Builders to expand strategically.

Affordability Gains in 2025

When are housing interest rates expected to drop below 6%? Likely mid-2026, assuming no major recession disruptions [realtor.com]. Already, affordability is improving, with lower rates reducing monthly payments significantly. For example, a $350,000 loan at 7% costs $2,328 monthly (principal and interest); at 6.32%, it’s $2,189—a 6% savings that draws buyers back. For Portfolio Builders, this signals a window to scale, as lower borrowing costs enhance ROI on rentals, particularly in high-demand markets. For Buy-and-Hold Strategists, it’s a chance to refinance existing properties, freeing up capital to reinvest or bolster reserves, ensuring stability in uncertain times.

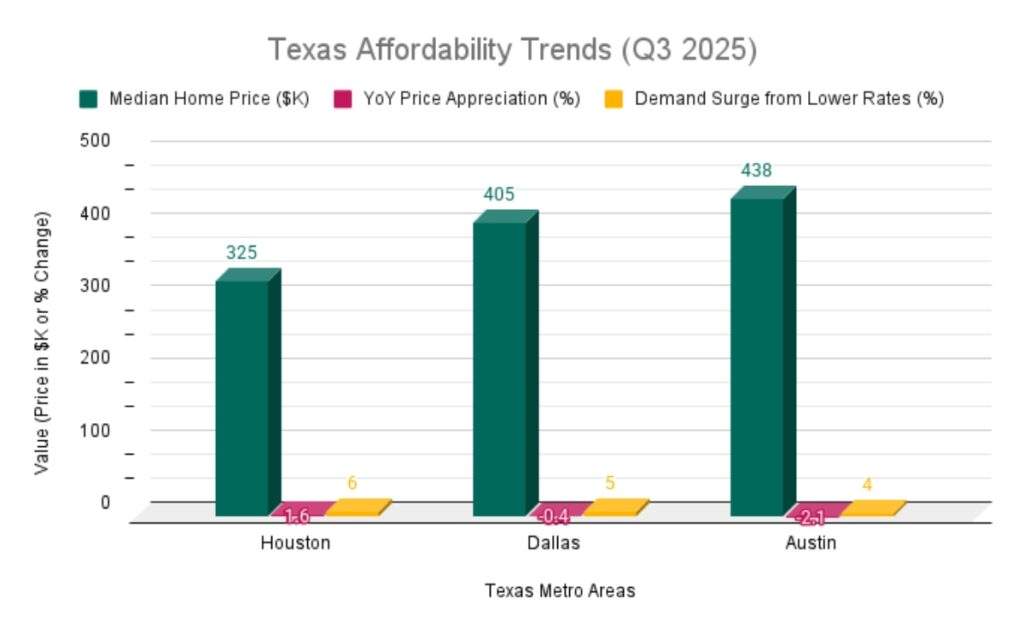

Texas Metros Seeing Demand Surges

Texas stands out in this rate cuts and recession dynamic. The Texas Triangle—Houston, Dallas, Austin—sees strong demand driven by rate relief and population growth. Austin’s tech boom attracts young professionals, pushing rental demand for single-family and multifamily properties. Houston’s energy sector ensures steady tenant bases, with entry-level homes under $300,000 appealing to first-time investors. Dallas, with its finance and logistics hubs, offers consistent 4-5% annual appreciation, making it a magnet for portfolio expansion. These metros deliver 6-8% cap rates, far above national averages, positioning Texas as a prime target for investors seeking both growth and resilience.

This chart illustrates Q3 2025 affordability trends in Texas metros, with Houston showing a 6% demand surge, Dallas maintaining stable appreciation, and Austin balancing high prices with a 4% demand increase, underscoring their investment potential.

Ready to capitalize on Texas’s thriving markets? Visit Elysium Real Estate Investments for tailored strategies to maximize your returns in Houston, Dallas, and Austin.

The Shadow of Recession

While rate cuts spark optimism, recession fears loom large. Economic slowdowns, coupled with wavering consumer confidence, could curb buyer demand. In the recession and housing market equation, investors must balance the benefits of lower rates against the risks of a downturn. This requires a proactive approach—focusing on resilient markets, diversifying income streams, and preparing for potential shifts in tenant behavior.

Job Losses & Buyer Confidence

Economic uncertainty is dampening buyer sentiment. Trade tensions and slower job growth make households hesitant, with many locked into low-rate mortgages from prior years. For Buy-and-Hold Strategists, this raises concerns about vacancy risks, as economic dips could lead to tenant turnover. However, history offers reassurance: the housing market weathered 2020’s downturn with minimal disruption compared to 2008. By focusing on high-demand areas like Texas and maintaining cash reserves, investors can protect cash flow and navigate short-term challenges with confidence.

Housing Price Resilience vs. Correction

Will prices crash? Unlikely. The market is stabilizing, supported by tight inventory and steady demand. A recession might soften prices slightly, but strong fundamentals—especially in diversified economies—prevent major corrections. Long-term appreciation remains a safe bet for diversified portfolios. Investors should focus on markets with strong fundamentals, like Texas, where demand and limited supply cushion against corrections.

Recession and Housing Market in Texas

Texas remains a stronghold. In 2008, its home prices fell just 4%—half the national average—thanks to a diversified economy spanning tech, energy, and finance. Today, steady migration fuels demand, particularly in Dallas, where rental occupancy rates hover near 94% [cbre.com]. Houston’s affordability attracts first-time buyers, while Austin’s vibrant tech scene supports premium rents. This resilience makes Texas a safe haven for investors navigating national uncertainty, offering both stability and growth potential.

Tug-of-War Dynamics

The rate cuts and recession battle is clear: lower rates drive demand, while economic fears curb confidence. Here’s a side-by-side look:

This chart highlights the push-pull: opportunity meets caution. For deeper insights and practical strategies, we invite you to explore our related guide on how to mitigate risk while pursuing high-growth real estate investments. This resource provides essential tips to navigate the state’s dynamic investment landscape with confidence.

Investor Strategy Guide

To win this tug-of-war, act decisively. Here’s a checklist for Buy-and-Hold Strategists and Portfolio Builders facing rate cuts and recession realities:

- Lock in Lower Rates/Refinance Now: With forecasts favoring cuts, refinance to save 5-10%. Fixed-rate loans protect against volatility. For example, refinancing a $500,000 loan from 7% to 6.32% saves $188 monthly, adding up to $11,280 over five years—capital that can fund new acquisitions. If you are curious about optimizing your investments during inflation, explore our detailed guide on how to optimize your investments during inflation, packed with strategies to enhance your portfolio’s performance.

- Focus on Resilient Metros (Houston, Dallas, Austin): The Texas Triangle offers consistent appreciation. Houston’s energy sector cushions downturns; Dallas delivers 7% multifamily yields. Austin’s tech-driven growth supports short-term rental strategies, with occupancy rates holding at 50-60% even in volatile times. Targeting these metros ensures steady demand and ROI, even if national markets face headwinds.

- Diversify Rental Mix: Combine short-term (Airbnb in Austin) and long-term leases for 20% risk reduction. Short-term rentals in tourist-heavy Austin can yield 10% higher returns than traditional leases, while long-term tenants in Houston provide stability. Use data analytics for tenant screening—our insights on data analytics in residential real estate show how to reduce default risks by 15% through predictive modeling.

Texas Market Outlook

Texas isn’t just weathering the recession and housing market storm—it’s thriving. The Texas Triangle nears 23 million residents, draws tech professionals to Austin, energy workers to Houston, and finance experts to Dallas, fueling rental and purchase demand, making Texas a beacon for investors seeking stability and growth [har.com].

Statewide median prices are projected to rise moderately, with affordable inventory easing entry for first-time investors. Texas’s 2008 resilience—prices down just 4% versus 10% nationally—signals strength. Unlike coastal markets that faced sharp corrections, Texas’s diversified economy avoided the worst of the bubble. Today, its low cost of living, no state income tax, and pro-business policies attract corporations and residents alike, ensuring long-term demand.

At Elysium Real Estate Investments, we help our clients navigate these powerful trends through a comprehensive suite of services:

- Business Planning: We identify the strongest sub-markets and asset types within the Texas Triangle based on real-time data.

- Asset Protection: We structure investments through entities that shield your personal assets from market volatility.

- Tax Planning: Our strategic approach aims to maximize your after-tax returns, preserving more of your wealth.

Conclusion

The tug-of-war between rate cuts and recession is intensifying: interest rates cut open doors, but economic uncertainty tests resolve. Texas metros like Houston, Dallas, and Austin offer opportunity, with affordability gains and resilience. Lower rates are boosting demand, but recession risks demand proactive strategies. Now is the time to act—whether refinancing to lock in savings, acquiring in high-demand markets, or diversifying to hedge risks.

At Elysium Real Estate Investments, we turn data into decisions. Our team helps you navigate volatility with tailored plans, from scaling portfolios in Texas’s thriving metros to protecting assets against downturns. Why not take a moment to Schedule Your FREE twenty-minute phone consultation with an Elysium Real Estate Investments advisor? It’s a great opportunity to speak with someone about refining your investment portfolio and preparing for your financial goals. We’re here to help you every step of the way!.

Additionally, Elysium Real Estate Investments LLC and its affiliates do not assume any fiduciary duty or responsibility to the reader. The article clarifies that past performance of any market or investment strategy is not a guarantee of future outcomes, and real estate investments come with inherent risks, including the possibility of losing principal. Economic conditions can change rapidly, and the information provided is based on publicly available data, current as of the publication date, with no liability accepted for any losses or damages resulting from its use..