The Federal Reserve’s recent interest rate cuts have sparked excitement among real estate investors, with many assuming lower borrowing costs will ignite a housing boom. But how Fed interest rate cuts affect housing prices is far more complex than it seems. Low rates alone don’t guarantee runaway demand or skyrocketing prices, especially in dynamic markets like Texas.

At Elysium Real Estate Investments, we believe in looking beyond the headlines to uncover what truly drives real estate growth. This article explores why federal reserve interest rate cuts 2025 housing forecast may not deliver the expected boom and how investors can navigate Texas’s resilient markets with confidence.

Fed Rate Cuts: The Immediate Impact

When the Federal Reserve lowers interest rates, the immediate effects ripple through the housing market, creating opportunities for both buyers and investors. Let’s break down the short-term impacts.

Mortgage Affordability Boost

Lower interest rates reduce borrowing costs, making mortgages more affordable. According to Freddie Mac, the 30-year fixed-rate mortgage dropped to 6.08% in September 2024, down from a high of 7.79% in October 2023. For a $400,000 home, this translates to a monthly payment reduction of approximately $300, easing the burden for first-time buyers and the Cautious New Investor who may see low rates as a green light to enter the market. This affordability boost can spark initial excitement, but it’s only part of the equation.

Surge in Buyer Interest

Rate cuts typically drive a surge in buyer inquiries, as seen in Texas’s high-demand metros like Austin and Dallas. According to the National Association of Realtors (NAR), existing-home sales rose 2% in July 2024 compared to June, signaling early buyer interest ahead of the Fed’s September rate cut.

Further upticks were expected post-cut as affordability improved. This reflects heightened interest but doesn’t always translate to closed deals, as other factors like inventory and pricing come into play. For Portfolio Builders, this surge signals an opportunity to assess market dynamics carefully before acting.

Fed Interest Rate Cuts 2025: What It Means Now

The Fed’s September 2025 projections indicate an additional 0.75 percentage points of rate cuts by the end of 2025 per Federal Open Market Committee projections, bringing the federal funds rate to a median of 3.6% per Federal Open Market Committee projections, creating a window for action. Lower federal reserve interest rate cuts and mortgage rates encourage refinancing, freeing up capital for investors to reinvest in properties.

However, as explored in our blog, How to 3x Your Real Estate Portfolio in 5 Years, short-term gains must be balanced with long-term strategies to avoid overleveraging. For investors wondering is it a good time to buy property when the Fed drops interest rates, a disciplined approach is key.

Why Low Rates Alone Don’t Guarantee a Boom

While low interest rates improve affordability, several limiting factors prevent an automatic housing surge. Understanding these constraints is critical for investors asking, will low interest rates cause a housing boom in 2025?

Housing Supply Shortages

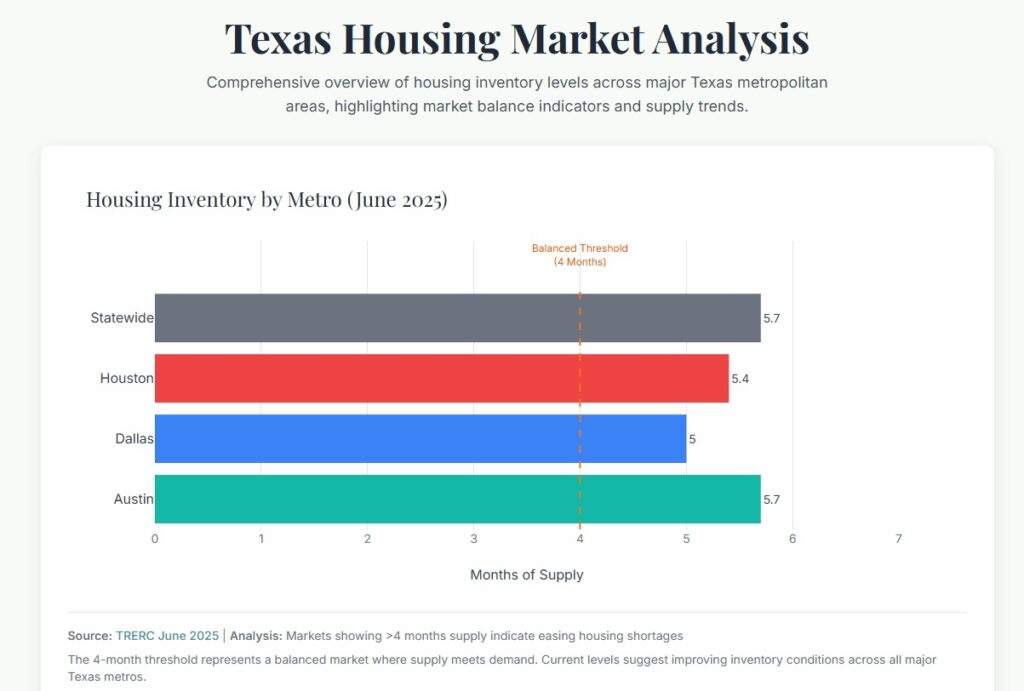

Texas continues to grapple with housing market imbalances, with inventory reaching 5.7 months’ supply in June 2025, per the Texas Real Estate Research Center—above the balanced threshold of 3–4 months and the highest since 2013. While this eases some shortages, elevated supply keeps prices under pressure (flat YoY statewide), counteracting the benefits of low interest rates effect on housing affordability.

In Austin, for instance, median home prices remain above $550,000 amid $24,000 average concessions, pricing out many buyers despite lower rates. This dynamic limits explosive demand absorption, tempering expectations for a boom.

Affordability Ceilings

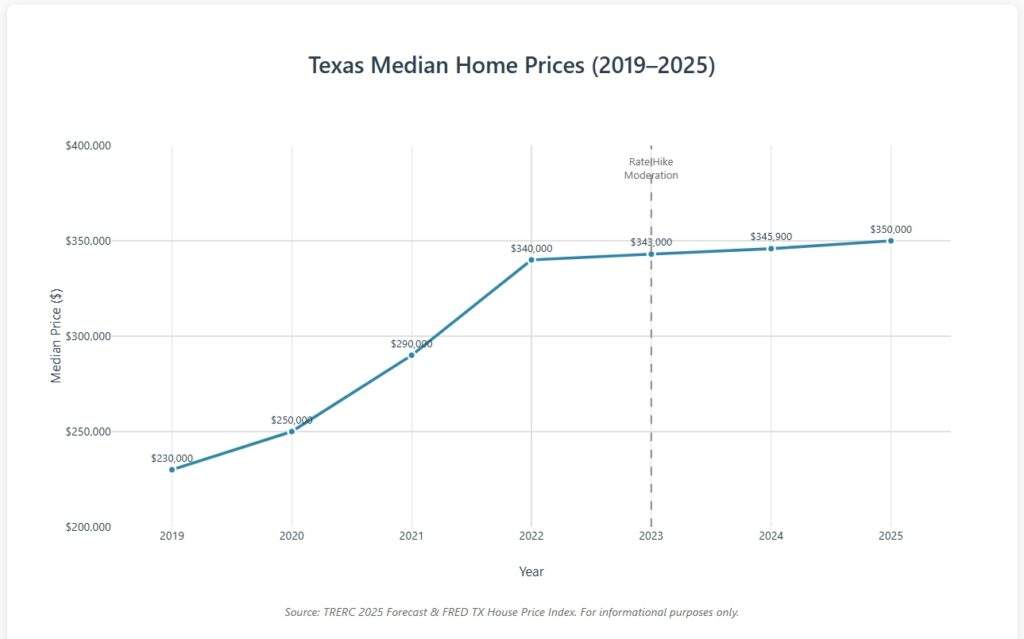

Even with lower rates, affordability remains a challenge. In Texas, home prices are rising steadily (up 1.7% year-over-year in January 2025 per the TRERC Home Price Index), while market liquidity for lower-priced homes stays constrained by mid-6% mortgage rates. This widening gap between home prices vs. wages continues to strain affordability, especially in metros where median household incomes haven’t kept pace with property values.

For the Cautious New Investor, this means lower monthly payments may still not make homeownership feasible amid uneven demand across price tiers. Investors must carefully evaluate local price-to-income ratios to determine whether rate cuts will truly unlock opportunities.

Inflation & Macroeconomic Pressures

Inflation and economic uncertainty can dampen the impact of rate cuts. Persistent inflationary pressures erode purchasing power and raise construction costs, limiting new housing development. Global economic headwinds, such as trade disruptions or rising energy costs, further reduce consumer confidence, making buyers hesitant even with favorable rates. These pressures highlight that how long will low interest rates impact the real estate market depends on broader economic stability.

To understand how to navigate the competing forces of lower interest rates and economic uncertainty, particularly in high-growth markets like Texas, explore our in-depth analysis: balancing rate cuts with recession risks in Texas. (insert the link to the article Rate Cuts and Recessionary Fears: A Tug-of-War for the Future of Housing once published)

Ready to navigate beyond rate-driven assumptions? Download our free Investor Strategy Checklist PDF for practical steps to build a resilient portfolio.

The Myth of Automatic Booms

History shows that low rates don’t always spark explosive housing growth. After the 2008 financial crisis, the Fed slashed rates to near-zero, yet the housing market took years to recover due to oversupply, foreclosures, and weak consumer confidence. In Texas, the 2015–2016 period of low rates saw steady appreciation but no bubble, thanks to diversified economies in Houston and Dallas.

For example, Houston’s energy sector stability supported demand without runaway price spikes. Dallas, similarly, benefited from corporate relocations, maintaining steady growth. These examples underscore that a housing boom isn’t guaranteed, and investors must focus on fundamentals over hype.

View our Myth vs. Reality chart below to see how low rates don’t always mean soaring prices.

| Myth | Reality |

|---|---|

| Low rates spark immediate housing price surges. | Post-2008, near-zero rates (0–0.25%, 2008–2015) didn’t drive a boom; 8.1 months’ inventory (2009) and 4% foreclosure rates delayed recovery to 2012 [https://fred.stlouisfed.org/series/FEDFUNDS]. |

| Low rates fuel price bubbles in strong markets like Texas. | In 2015–2016, Houston’s ~3.65% mortgage rates led to steady 5.8–6.2% YoY price growth with ~3.1 months’ inventory, stabilized by energy sector demand [https://trerc.tamu.edu/data/home-price-index/]. |

| Corporate growth amplifies rate-driven price spikes. | Dallas’s 2015–2016 relocations (e.g., Toyota HQ) drove ~6.8–7.1% YoY price growth with ~2.9 months’ inventory, not a bubble, due to balanced demand [https://trerc.tamu.edu/data/home-price-index/]. |

|

Myth

|

Reality

|

|

|---|---|---|

|

1

|

H

|

|

|

2

|

He

|

|

|

3

|

Li

|

|

The Bigger Picture: Beyond Rates

To understand how Fed rate cuts affect real estate portfolios, investors must look at the broader drivers shaping Texas’s housing market. These factors offer a clearer picture of where opportunities lie.

Demographics

Texas’s population grew by 1.8% in 2024 (adding 562,941 residents), per the U.S. Census Bureau, driven by net domestic and international migration to metros like Houston, Austin, and Dallas. This influx supports housing demand, particularly for rentals, as young professionals and families seek affordable options. For Portfolio Builders, this trend highlights the value of investing in high-growth areas where demand remains robust regardless of rate fluctuations.

Employment Stability

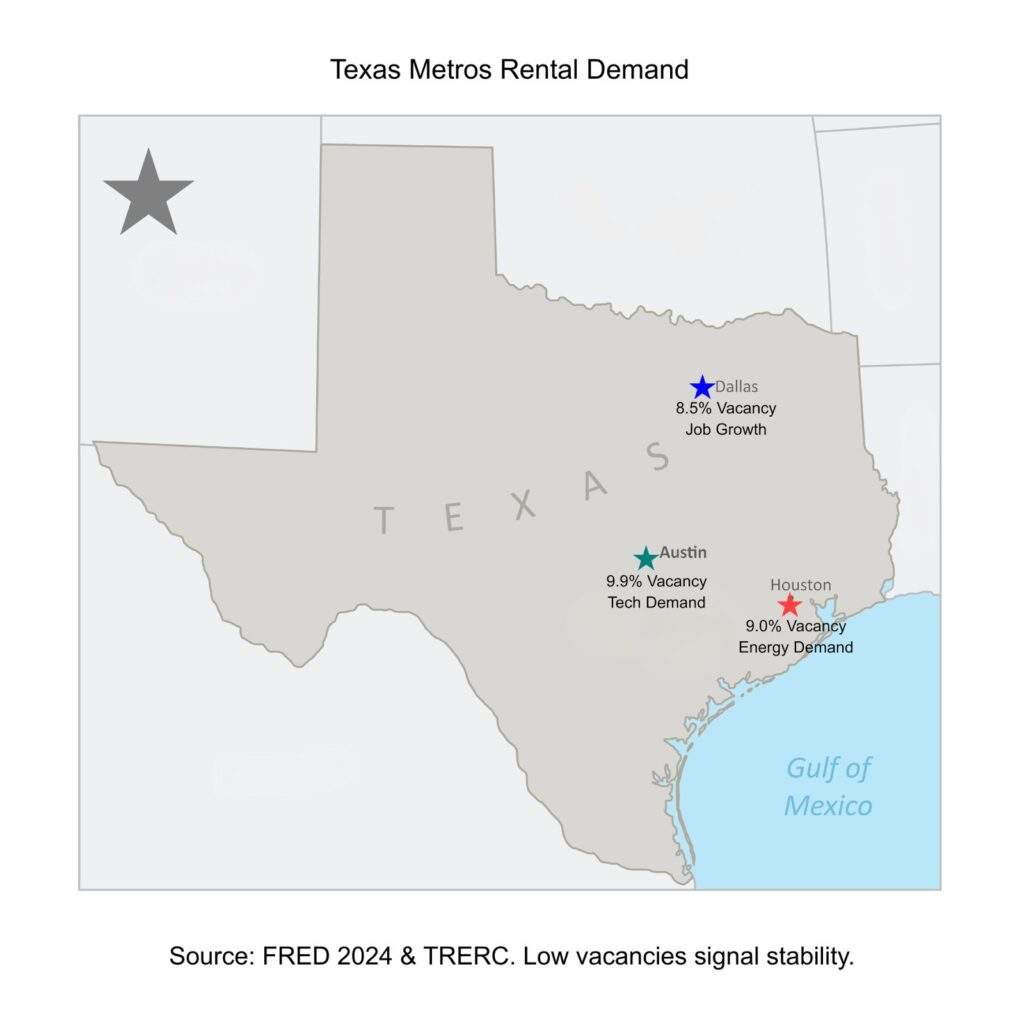

Texas’s diversified economy, with strong tech and energy sectors, provides employment stability. Austin’s tech hub, home to companies like Tesla and continues to attract skilled labor. Houston’s energy industry also plays a key role in the state’s employment base.

Stable employment supports consistent housing demand, making Texas a safe bet for long-term investors. This stability is especially critical when assessing fed rate cuts and real estate investment opportunities, as it reduces reliance on rate-driven trends.

Investor Confidence & Rental Demand

The rental market remains a bright spot, with rental vacancy rates in Texas at 9.2% in Q2 2024, per the U.S. Census Bureau (via Macrotrends), signaling steady demand. Investors can capitalize on this by focusing on rental properties, which offer steady cash flow and hedge against market volatility.

For Cautious New Investors, rentals provide a lower-risk entry point, while Portfolio Builders can scale their portfolios with diversified assets. To explore strategies for maximizing growth while minimizing risks, check out our in-depth insights on mitigating risk in high-growth Texas real estate. This resource offers essential insights to build a resilient portfolio in the state.

Regulatory and Policy Considerations

Beyond economic factors, regulatory changes also influence the housing market. In Texas, zoning laws and development regulations can restrict new construction, exacerbating supply shortages. For example, Austin’s strict zoning policies have limited multifamily development, keeping inventory tight.

Additionally, property tax policies in Texas, while favorable compared to other states, require careful navigation to maximize returns. Investors must stay informed about local policies, as they can impact how Fed interest rate cuts affect housing prices.

Elysium’s expertise in navigating these complexities ensures clients make informed decisions. For a deeper understanding of tax advantages, visit our specialized guide on leveraging new tax provisions for Texas real estate investments, offering valuable tools to optimize your portfolio’s financial efficiency.

Investor Strategy Guide

To navigate the 2025 market, investors must adopt a disciplined, data-driven approach. Here’s an expanded checklist to guide your strategy:

- Don’t rely solely on Fed moves: Low rates are just one factor. Base decisions on supply, demand, and local trends.

- Focus on resilient Texas metros: Houston, Austin, and Dallas offer strong fundamentals.

- Hedge with rental income strategies: Rental properties provide stability amid uncertainty.

- Monitor regulatory changes: Stay updated on zoning and tax policies to anticipate market shifts. For deeper insights on managing tariffs, rising material costs, and permitting delays, explore our latest analysis on how evolving trade policies are reshaping real estate economics.

- Leverage infrastructure trends: Invest in areas benefiting from urban development for long-term appreciation.

- Diversify across property types: Combine single-family homes, multifamily units, and commercial properties to spread risk.

- Conduct thorough market research: Analyze local data to identify high-ROI opportunities.

Fed rate cuts and real estate investment opportunities require a long-term perspective. Download our Investor Strategy Checklist PDF to build a portfolio that thrives beyond rate fluctuations.

See our Investor Strategy Checklist chart below for a visual guide to prioritizing your investments.

Texas Market Outlook

Texas’s resilience makes it a prime destination for real estate investment. The Texas Triangle (Houston, Austin, Dallas) benefits from demographic growth, economic diversity, and strong rental demand. Elysium Real Estate Investments leverages Business Planning, Asset Protection, and Tax Planning to guide clients toward high-ROI opportunities.

Our data-driven models identify markets within the Triangle poised for growth, even if national trends soften. For example, Dallas’s balanced inventory and job growth make it a standout for rental investments, while Austin’s tech-driven demand supports long-term appreciation. Houston’s energy sector and port activity further diversify opportunities, ensuring stability. Elysium’s tailored strategies help both Cautious New Investors and Portfolio Builders capitalize on these trends while mitigating risks.

Texas Market Snapshot

Check out our Texas Market Snapshot charts below to visualize key demand drivers.

Conclusion

Low interest rates create opportunities, but they don’t guarantee a housing boom in 2025. Factors like supply shortages, affordability ceilings, inflation, regulatory constraints, and infrastructure developments play significant roles. By focusing on Texas’s resilient fundamentals—demographic growth, employment stability, rental demand, and urban development—investors can build portfolios that thrive beyond the headlines.

Excited to take advantage of the 2025 housing market? Let Elysium Real Estate Investments help you create the perfect strategy! Schedule a FREE thirty-minute confidential consultation with one of our experienced advisors over Zoom.

Legal Disclaimer: This article, “Will Low Rates Last? Why the Fed’s Move Doesn’t Guarantee a Housing Boom,” is strictly for informational, educational, and general market analysis purposes only and does not constitute professional financial, investment, tax, or legal advice. Any discussion regarding Fed rate cuts, housing market forecasts, or specific Texas trends is solely Elysium Real Estate Investments LLC’s opinion and perspective based on publicly available data. We assume no fiduciary duty or contractual responsibility to the reader.

All content in this article is subject to market risks and rapid economic change. There is no guarantee that any forecasts, estimates, or opinions provided will be realized, and all investments inherently carry the risk of financial loss. Therefore, before making any decisions related to refinancing, property acquisition, or asset management, you must consult with your own independent, licensed financial advisor, tax professional, and legal counsel. By continuing to read, you acknowledge and agree that Elysium Real Estate Investments LLC is not liable for any direct or indirect damages resulting from your reliance on the content within this article.